Foreign investments represent an important part of the growth of Brazilian and Latin American startups. Although the COVID-19 pandemic has harmed the global venture capital market, with Foreign Direct Investment (FDI) falling by 35% worldwide, the year 2022 presents an optimistic scenario. Understand why seeking foreign investment for your business in this article and learn about the predictions for FDI.

According to data gathered by the Distrito platform, in 2022, foreign investors participated in 39% of rounds that took place from January to April for startups founded in Brazil. Of this number, 24% also had the participation of Brazilian investors, while 15% were made only by foreigners.

In Late Stage rounds, we see an even greater participation of foreign venture capital funds, with Battery Ventures leading Flash’s Series B, Next47 leading Tractian’s Series A, Tiger Global leading Zippi’s Series A, among others.

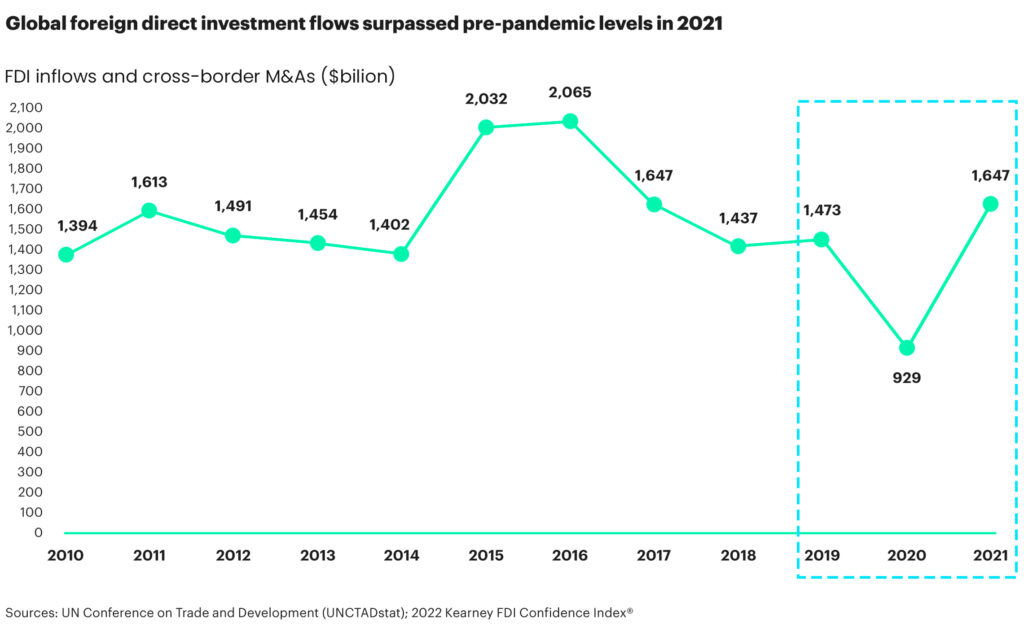

According to the Kearney Foreign Direct Investment Confidence Index study, which presents the confidence index of investors, there are reasons for optimism regarding Foreign Direct Investment. Following the global economic recovery of 2021 (6% growth), FDI movement grew by 77% compared to 2020, reaching approximately US$1.65 trillion in 2021.

The numbers exceeded pre-pandemic levels when direct investments totaled about US$1.5 trillion. Follow the graph below.

The Kearney Foreign Direct Investment Confidence Index survey also points out that 76% of leaders interviewed plan to increase Foreign Direct Investment in the next three years.

In addition, 83% cited that FDI is becoming increasingly important for profitability and competitiveness in the corporate environment. The trend is for this to continue in the coming years.

The positive prospects also apply to the global economy. The investors participating in the survey showed that they believe that the world economy is heating up: 63% said they are more optimistic than pessimistic. This was most evident in the Americas, where optimism was expressed by 69% of those surveyed, followed by the Asia-Pacific (63%) and Europe (59%).

On the other hand, startups are facing a delicate moment, with news of mass layoffs carried out by various unicorns, even after receiving capital offers, signals that point to a possible crisis in the sector.

However, there are still positive prospects when it comes to FDI. With signs of global economic recovery and a more optimistic stance regarding foreign investment, we have a favorable scenario for Latin American startups that intend to raise funds with foreign partners.

Foreign Investment in Latin America

This growing interest of foreign investors has been important for the capitalization and expansion of LATAM companies. Due to the development of the innovation and technology ecosystem in the region, investors have begun to see opportunities in Latin American countries.

However, there are still insecurities on the part of foreign investors in investing in emerging countries. In Brazil, historically, we have dealt with strong political and economic instability.

In addition to instability, the tax burden also represents an obstacle for investors. That’s why several startups in Brazil and Latin America seek to set up a legal structure outside the country – most often, a holding company in the Cayman Islands, with another company in Delaware, and below, the Brazilian operation. Follow Trace’s blog to learn more about this subject!

This way, it is possible to have access to investors who are looking for opportunities and, consequently, contribute to the capitalization of the country’s startups.

The countries most present in investments in Brazil are the United States, Germany, and Japan – combining the participation of the three, they were present in 700 deals in the country in the last ten years.

How to bring this investment to Brazil?

Once the fundraising is done, it is necessary to bring the received value to Brazil. This international transfer can be time-consuming and bureaucratic, as traditional banks do not offer simplified solutions for these types of operations; the spread practiced by these institutions can reach up to 4%. Moreover, the period to complete the transaction can take up to two months.

Fortunately, companies like Trace have already developed solutions to make this process much simpler and less costly. Due to its partnership with more than 15 banks and the absence of intermediaries, Trace has the best rates in the market and allows your investment to be received in up to 1 day, making it easier to search for foreign investment and complete the entire process.

If you want to better understand how Trace can contribute to your startup’s journey, get in touch!