The Latin American startup ecosystem has drawn attention from around the world due to its rapid development and concentration of promising businesses. In just the first three months of 2022, latin startups raised R$2.8 billion in investments. Gain a better understanding of the region’s potential and learn which markets are most attractive to investors.

Venture capital investments in Latin America have been increasing year over year. According to research conducted by LAVCA (Association for Private Capital Investment in Latin America), in 2021, the amount invested reached US$15.7 billion, which is more than three times the previous record of US$4.9 billion in 2019. The total amount invested in 2021 is even greater than the sum of investments made in the past 10 years.

As a result of the region’s development, numerous unicorns have emerged, with 16 startups reaching a valuation of over US$1 billion in 2021. These startups include Bitso, CargoX, Clara, Clip, CloudWalk, Facily, Konfio, olist, MadeiraMadeira, Merama, Mercado Bitcoin, MURAL, NotCo, Tiendanube/Nuvemshop, Ualá, and unico.

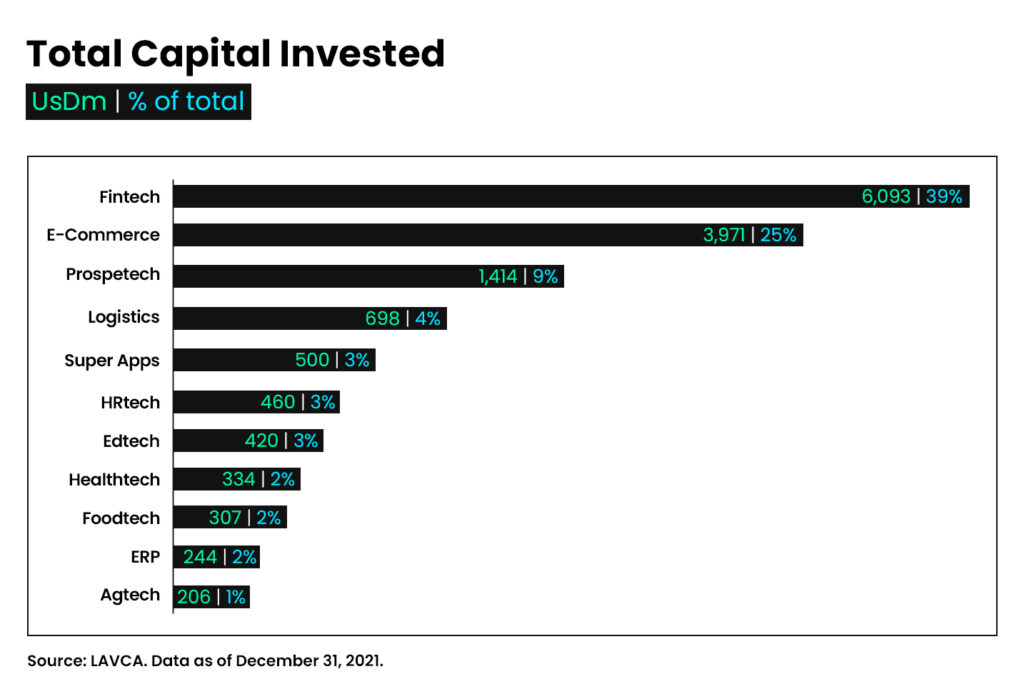

Highlighted Sectors in the Region

According to data published by LAVCA, the top three sectors in Latin America are fintech, e-commerce, and proptech. Fintech is in the lead with a total of US$6.1 billion invested, followed by US$3.9 billion in e-commerce and US$1.4 billion in proptech, as shown in the table below:

In fintech, the most invested verticals since 2019 have been consumer credit and banks. However, investors are beginning to support other financial aspects such as payment technologies, banking services, and Buy-Now-Pay-Later (BNPL).

Most Promising Markets in Latin America

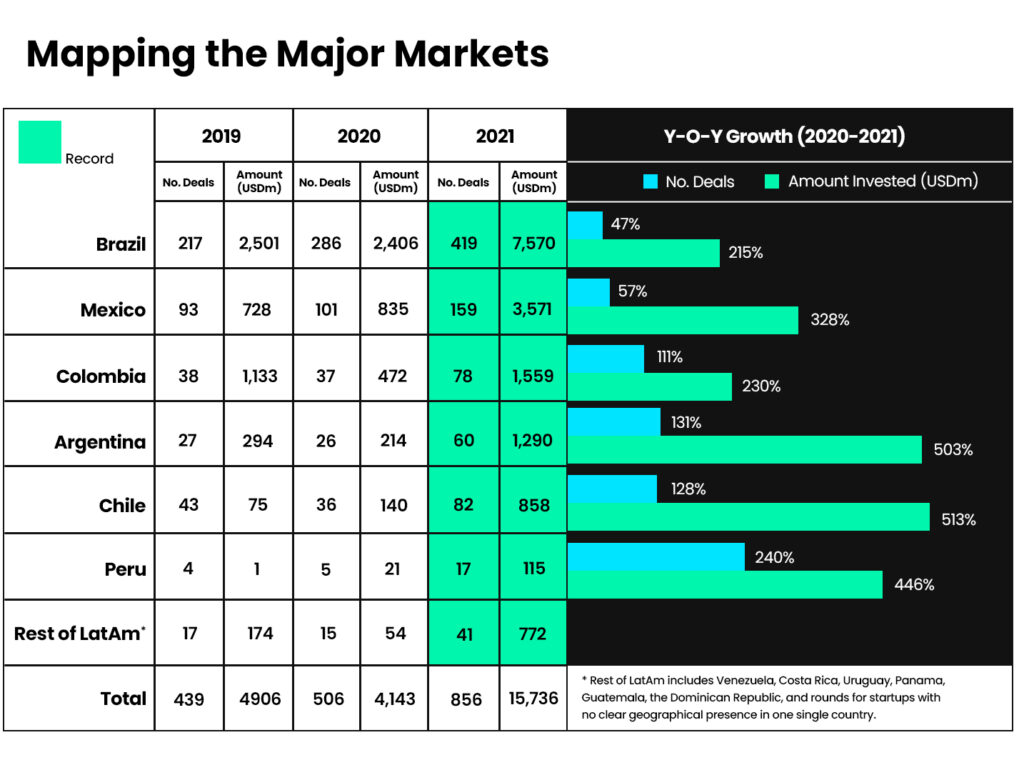

Research published by LAVCA identifies Brazil, Mexico, Colombia, Chile, and Peru as the five largest markets in terms of innovation in Latin America.

Brazil leads with the highest number of investments and the highest amount invested in 2019, 2020, and 2021, as shown in the table below. From 2020 to 2021, the year-on-year growth was 47% for the number of closed deals and 215% for the total investment in dollars – an amount that reached over US$7.5 billion in 2021.

In second place is Mexico, which received a total investment of US$3.5 billion in 2021, representing a 328% growth compared to the total in 2020 of US$835 million.

Colombia closed 2021 with a total investment of US$1.5 billion, 230% higher than the total in 2020 (US$472 million). Argentina, Chile, and Peru are ranked fourth, fifth, and sixth, respectively, with lower total investments but significant year-on-year growth (see table).

Latin American Startups

The rapid development of the region’s innovation ecosystem and the emergence of promising businesses have led investors from around the world to seek investment opportunities here.

Latin American startups can take advantage of this opportunity to seek foreign investment and access venture capital funds from more established markets beyond their own country. For example, US funds have more market maturity and more capital available for investments. Another important point is that competition in countries such as the United States is higher, so VCs are usually willing to offer more attractive proposals to close a deal. Learn about other advantages here!

Trace and Latin American Startups

At Trace, we promote the expansion of Latin startups through valuable content, events that connects Latin startups and venture capital funds, as well as simplify the transfer of the round from abroad to Brazil.

Learn more about our solutions and how we can contribute to your startup, click here!