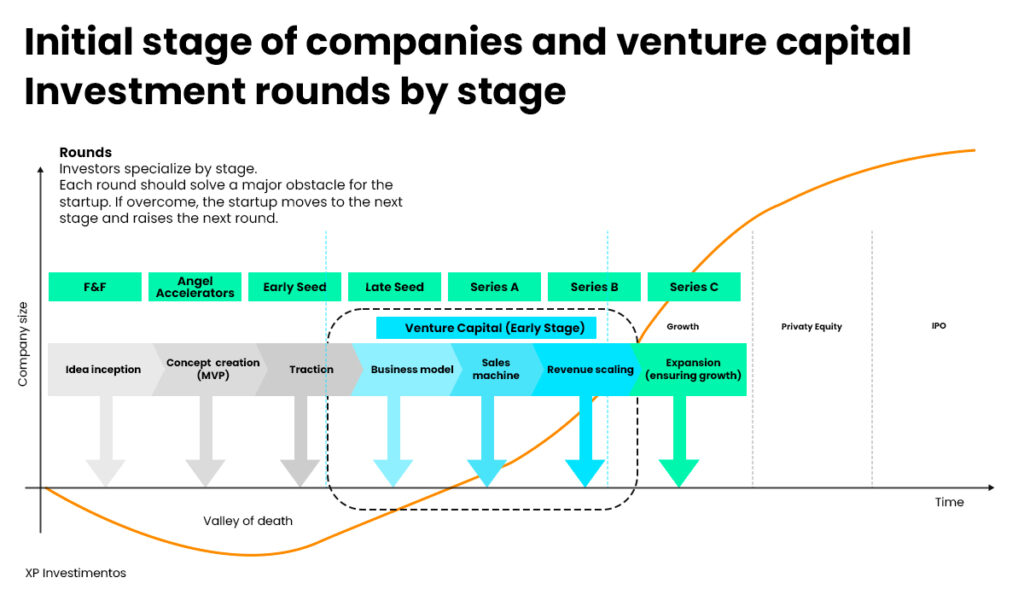

Raising investment rounds by business stage is a practice that is part of the growth and scaling of startups. In this post, we will cover all stages of a company’s fundraising, from angel investment to series C.

It is important to keep in mind that a startup’s investment rounds should be in line with the stage of the business. When the company is still in its infancy, at a time when entrepreneurs have an idea and need capital to put it into practice, it is advisable to seek financial support from people close to them – an investment known as F&F, family and friends.

The caveat of seeking funds from investors at this early stage is the difficulty of proving that your startup has traction and can be a good long-term investment, as it may not have enough time, customers, or sales for that.

From the MVP, Minimum Viable Product – when the company already has its concept defined and a preview of what it can deliver to the market – it is possible to count on investment from angel accelerators.

Follow in the image below the investment rounds by business stage.

Investment round by stage: from angel to series C

Angel investment

After the support of acquaintances during the F&F stage, angel investment is the first stage of fundraising for a startup, usually carried out by individual investors or small groups of investors.

It is common for the company to still be in the initial development stage or in the product or service testing phase, as at the time of the MVP, as you saw above (see image). Angel investment usually ranges from $10,000 to $100,000 and investors, in addition to capital, can offer mentoring and support to the business.

Seed

The seed round occurs shortly after the angel investment, when the startup needs more capital to start production or expand the product.

Generally, this phase involves the raising of institutional investor or venture capital resources, with values ranging from $100,000 to $500,000. At this stage, the startup may not yet have a validated product or service, but shows potential for growth.

Series A

Series A is the next stage, at a time when investors are most interested in companies that have a product or service validated by the market and a scalable business model.

Usually, companies are at the moment of expanding the team and implementing technological advances. The invested values usually range from $500,000 to $2 million.

Series B

Series B occurs when the company already has a consolidated business model and seeks capital to expand its businesses into new markets or acquire other companies.

Here, the focus is usually on increasing revenue and seeking sustainability so that the startup does not need more injections of capital. The invested values can range from $2 million to $10 million.

Series C

Series C is the last investment stage before most companies go public on the stock exchange or are acquired by another company; some startups continue to raise rounds D, E, and so on. At this stage, the company already has a well-consolidated product or service and a highly scalable business model. The invested values can range from $20 million to $300 million.

Investment round by stage: learn from market leaders

To learn more about the innovation market and learn from those at the forefront of standout startups, click here and access all the content of Brazil VC Week, an event that brought together big names in the sector.